To curb the menace of black money and round tripping of funds, the Ministry has introduced many measures to send a strong message to the existing companies. One of the recent measures taken by the MCA in this regard is to get information about the ultimate individual beneficial shareholder of a company. The Ministry in this regard had redrafted the provisions of Section 90 of the Companies Act 2013. Through this notification a step has been taken by the Ministry to reveal legitimate individual owner hiding behind anonymity and layers of shell Companies.

AMENDED PROVISIONS UNDER COMPANEIS ACT, 2013:

Amendment to Section 89 and 90 is one of the key amendments brought in by the Companies (Amendment) Act, 2017 (‘Amendment Act’). While, the Amendment Act has been enforced in phases, stakeholders were given the option to provide the public comments on the draft Rules in relation to Significant Beneficial Ownership (SBO), which was issued by MCA on Feb 2, 2018. Thereafter, on June 14, 2018, MCA vide its Notification, has enforced the provisions of amended Section 90 of the Companies Act, 2013 and also issued the Companies (Beneficial Interest and Significant Beneficial Interest) Rules, 2019 (‘SBO Rules’) in relation to the determination of SBO. Thereafter, considering various practical difficulties in implementing the provisions of the SBO Rules, MCA on February 8, 2019 has notified the revised rules in order to facilitate better implementation of the provisions.

LET’S DISCUSS WITH SOME FAQ’S

- Who is Significant Beneficial Owner (SBO)?

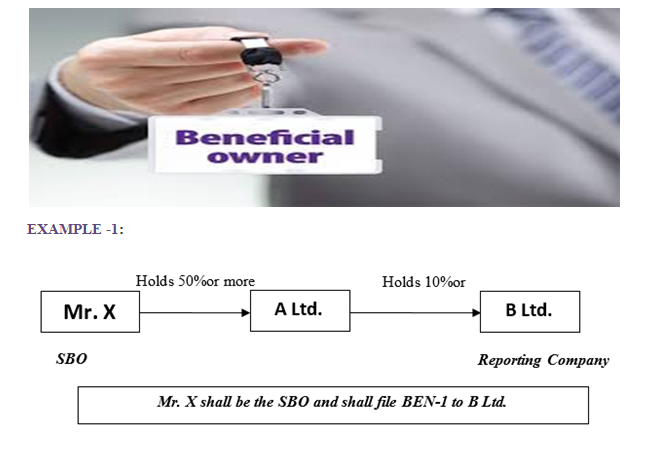

Any person (singly or along with other person including trust and person’s resident outside India) shall become SBO with respect to shares in a company if:

| CONDITION 1 | OR |

CONDITION 2 |

| Holds indirectly, or together with any direct holdings, not less than ten percent of the shares;OR Has right to receive or participate in not less than ten percent of the total distributable dividend, or any other distribution, in a financial year through indirect holdings alone, or together with any direct holdings; OR |

Holds indirectly, or together with any direct holdings, not less than ten percent of the voting rights in the shares; OR Has right to exercise or actually exercises, directly or indirectly, significant influence or control, in any manner other than through direct holdings alone.” Control as defined under Section 2 (27) of the Companies Act, 2013. |

Therefore, the threshold for determination of SBO has been lowered to 10%.

- http://www.mca.gov.in/Ministry/pdf/DraftRulesBeneficialOwnership_15022018.pdf

- http://www.mca.gov.in/Ministry/pdf/CompaniesSignificantBeneficial1306_14062018.pdf

- http://www.mca.gov.in/Ministry/pdf/CompaniesOwnersAmendmentRules_08020219.pdf

- Compliance required on part of “SBO”

The Compliances required on part SBO have been enumerated below:

Initial Disclosure:

Every individual who is a SBO in a reporting Company, is required to file a declaration in Form No. BEN-1 to the reporting company within 90 days from February 8, 2019.

Continual Disclosure:

Every individual, who subsequently becomes a SBO or where his significant beneficial ownership undergoes any change shall file a declaration in Form No. BEN-1 to the reporting company, within 30 days of acquiring such significant beneficial ownership or any change therein.

Clarification w.r.t. becoming the SBO or any change therein during the transition time:

Where an individual becomes a SBO, or where his significant beneficial ownership undergoes any change, within 90 days of the commencement of the Companies (Significant Beneficial Owners) Amendment Rules, 2019, it shall be deemed that such individual became the significant beneficial owner or any change therein happened on the date of expiry of ninety (90) daysfrom the date of commencement of said rules, and the period of 30 days for filing will be reckoned accordingly.

Any failure to comply with the disclosure requirement in the form of declaration will attract minimum fine of INR 100,000/- which may extent to INR 10,00,000/-. In addition to this, per day penalty of INR 1000/- will also be applicable for each day of continuing default.

- Compliance required on part of “Company”:

The Compliances required on part of Company have been enumerated below:

The Company is required to file such declaration as received from a SBO within 30 days from the receipt, in Form No.BEN-2 to the Registrar of Companies along with the fees as prescribed in Companies (Registration offices and fees) Rules, 2014.

The Company is also required to maintain register for such declarations received from SBO in the format prescribed in Form BEN-3.

The company is made liable to send notice (BEN-4) for obtaining declaration from the SBO in case where suo motto declaration has not been received.

In case even after sending of notice, declaration from the SBO has not been received, then the company is mandatorily required to move an application to the Tribunal (NCLT).

Any failure shall attract penalty of INR. 10,00,000/- which may extent to INR 50,00,000/- on the Company and every officer who is default. In addition to this, per day penalty of INR 1000/- will also be applicable for each day of continuing default.

4. Exemption under SBO Rules

The rules are not applicable to the extent the share of the reporting company is held by:

- IEPF authority;

- Its holding reporting company, however, the details of such holding reporting company shall be reported in Form No. BEN-2;

- The Central Government, State Government or any local Authority;

- Reporting company; or a body corporate; or an entity, controlled by the Central Government or by any Stare Government or Governments or partially by the Central Government and partly by one or more State Governments;

- SEBI registered Investment Vehicles such as mutual funds, alternative investment funds (AIF), Real Estate Investment Trusts (REITs), Infrastructure Investment Trust (lnVITs) regulated by the Securities and Exchange Board of India;

- Investment Vehicles regulated by Reserve Bank of India, or Insurance Regulatory and Development Authority of India, or Pension Fund Regulatory and Development Authority.

Conclusion:

From the above, it can be concluded that these stringent additions in the provisions of the Law are to find out about the actual owners having significant influence in Companies or having Control under the entities registered under the law by lifting of veil on such shareholding”.

Leave A Comment

You must be logged in to post a comment.